A better partner in the business of cyber risk

Grow your business with industry-leading cyber insurance solutions and support from Corvus, a subsidiary of Travelers.

Corvus is part of the Travelers family

As a subsidiary of Travelers Insurance, Corvus offers market-leading innovation backed by proven financial stability. Our Smart Cyber Insurance® and Smart Tech E+O® products are written on Travelers paper, with an AM Best Financial Strength Rating of A++ (Superior).

Smart Cyber Insurance®

Smart Tech E+O® Insurance

Corvus London Markets

![[PARTNER HEADSHOT] Robert Horn - First VP & Cyber Product Co-Leader, Alliant [PARTNER HEADSHOT] Robert Horn - First VP & Cyber Product Co-Leader, Alliant](https://www.corvusinsurance.com/hs-fs/hubfs/robert-horn-headshot-blue-background.png?width=250&height=250&name=robert-horn-headshot-blue-background.png)

Testimonial

“Corvus went the extra mile...”

Corvus went the extra mile to offer our policyholders continuous threat monitoring and even discounts for practicing good security posture.

Robert Horn • First VP Cyber Product Co-Leader, Alliant

Expert Partnership

The Corvus solution

At Corvus, our priority is partnership. Whether you need support with a complex quote or insights on the latest threats, our in-house team of experts are just a phone call or email away.

Partner with expert underwriters

Our expert cyber underwriters are dedicated to helping more businesses become insurable. We’ll work with you to tailor each quote and find creative solutions to complex risks—providing fast, accurate, and fully customized quotes for your clients.

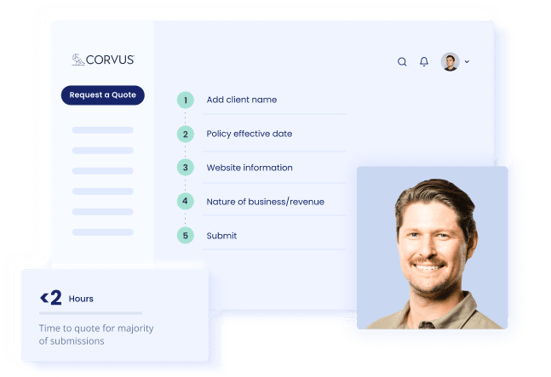

![[DASHBOARD DIAGRAM] Corvus provides fast, data-driven quotes](https://www.corvusinsurance.com/hs-fs/hubfs/broker%20hub%20data%20diagram.png?width=584&height=400&name=broker%20hub%20data%20diagram.png)

Fast, data-driven quotes

We leverage our industry-leading data to deliver rapid quotes tailored to each business. Get a quote in under two hours for most submissions, or an autoquote in less than a minute for eligible businesses.

![[DIAGRAM] The answers you need, when you need them](https://www.corvusinsurance.com/hs-fs/hubfs/the-answers-you-need-when-you-need-them%20(1).png?width=551&height=503&name=the-answers-you-need-when-you-need-them%20(1).png)

The answers you need, when you need them

Access on-demand support from our team of in-house cybersecurity, threat intelligence, and incident response experts. We’re here to help, with the insights and resources that you and your clients need to predict, prevent, and get ahead of cyber threats.

![[DIAGRAM] The answers you need, when you need them](https://www.corvusinsurance.com/hs-fs/hubfs/the-answers-you-need-when-you-need-them%20(1).png?width=551&height=503&name=the-answers-you-need-when-you-need-them%20(1).png)

![[DIAGRAM] Enhanced cyber renewals from Corvus](https://www.corvusinsurance.com/hs-fs/hubfs/Enhanced%20Renewals%20Diagram_V1.webp?width=553&height=286&name=Enhanced%20Renewals%20Diagram_V1.webp)

Enhanced cyber renewal process

Reduce the time you spend on renewals for qualifying small business accounts thanks to our enhanced cyber renewal process, featuring a click-and-bind option with no application required.

Broker Platform

An all-in-one platform built for cyber brokers

The Corvus Broker Platform is purpose-built for ease of use and speed. From fast, customized quotes to a library of selling tools, access everything you need to support and advise your clients.

Get an autoquote in minutes for eligible businesses

Customize quote letters

-

Access cyber insurance coverage and security control guides, a ransomware calculator, and more helpful selling tools

-

View client submissions, policies, claims, and your team, all in one place

Resources

Expand your cyber knowledge

Get the latest insights on emerging threats and how to reduce cyber risk, plus resources to help inform your clients.

![[DOWNLOAD GUIDE] Your Partner in Cyber Risk (Corvus Signal Policyholder Benefits Guide)](https://www.corvusinsurance.com/hs-fs/hubfs/Your%20Partner%20in%20Cyber%20Risk%201.jpg?width=356&height=200&name=Your%20Partner%20in%20Cyber%20Risk%201.jpg)

![[INDUSTRY LIST] Highly Desirable Industries 2023](https://www.corvusinsurance.com/hs-fs/hubfs/Highly%20Desirable%20Industries%201.jpg?width=356&height=200&name=Highly%20Desirable%20Industries%201.jpg)

Partner with Corvus

Get appointed and grow your business with Corvus. Our cyber insurance solutions are backed by expert guidance, industry-leading threat intelligence, and intuitive tools to simplify risk management—for you and your clients.

FAQ

Frequently asked questions

Corvus Insurance is building a safer world through insurance products and digital tools that reduce risk, increase transparency, and improve resilience for policyholders and program partners. Our market-leading specialty insurance products are enabled by advanced data science and include Smart Cyber Insurance® and Smart Tech E+O®. Our digital platforms and tools enable efficient quoting and binding and proactive risk mitigation.

Corvus Insurance offers insurance products in the U.S., Middle East, Europe, Canada, and Australia. Corvus Insurance, Corvus London Markets, and Corvus Germany are the marketing names used to refer to Corvus Insurance Agency, LLC; Corvus Agency Limited; and Corvus Underwriting GmbH. All entities are subsidiaries of Corvus Insurance Holdings, Inc. Corvus Insurance, a wholly owned subsidiary of The Travelers Companies, Inc., was founded in 2017 and is headquartered in Boston, Massachusetts with offices across the U.S., in the UK, and Germany. For more information, visit corvusinsurance.com.

Corvus Insurance was founded in 2017 and is headquartered in Boston, Massachusetts with offices across the U.S., in the UK, and Germany.

Corvus collaborates with the top cyber insurance brokers in the market, including both wholesale brokers and retail brokers. These partnerships emphasize expertise in cyber risk management, ensuring clients receive tailored coverage that addresses evolving digital threats and cyber exposure such as social engineering, business email compromise, and ransomware attacks. Corvus values partnerships with brokers committed to client education, creating a network that enhances the accessibility and effectiveness of cyber insurance solutions across different industries and business sizes.

Whenever you receive a quote for Smart Cyber Insurance® or Smart Tech E+O® Insurance, the coverage options you see are based in part on a risk assessment of a company’s IT system by the Corvus Scan. The scan gathers relevant information that can be accessed without logging into or exploiting the client’s systems. It evaluates potential risks by looking at obvious aspects, such as a company’s public-facing website, as well as lesser-known vulnerabilities, including bits of software embedded in a company’s web applications or unused company domains. Corvus does not require access to servers and does not require a password.

Smart Cyber Insurance® covers primary and excess risks for businesses earning up to $5B in gross annual revenue, with limits up to $10M.

We leverage our industry-leading data to deliver rapid, fully customized quotes using our cyber insurance underwriting platform. Get a quote in under two hours for most submissions, or an autoquote in less than a minute for eligible businesses. If you have any questions along the way or need help with a unique case, our expert underwriting team is here to help. API-based quoting is also available through our Distribution Partnerships.

We cover the following industry classes:

-

Healthcare

-

Retail

-

Financial Institutions

-

Education

-

Professional Services

-

Life Sciences

-

Manufacturing

-

Construction

-

And more!

Smart Tech E+O® insurance covers primary and excess risks for businesses earning up to $2B in gross annual revenue, with limits up to $5M and retentions as low as $2,500.

We leverage our best-in-industry data to deliver rapid, fully customized quotes for cyber coverage. We can typically turn around a quote in under two hours for most submissions thanks to our underwriting technology. If you have any questions along the way or need help with a unique case, our expert underwriters are here to help. API-based quoting is also available through our Distribution Partnerships.

Most technology-based services companies are eligible, including:

-

IT Consultants

-

Data Analytics

-

IT Staffing Firms

-

Telecommunication Service Providers and Consultants

-

E-Cycling and Shredding

-

Software Developers

-

Digital Advertising Agencies

-

Web Design and Hosting

-

Technology Hardware Developers

-

Software-as-a-Service (Saas)

-

Value Added Resellers

We hire the best minds in cyber, so you can count on highly informed and responsive underwriting. From submission to bind, our expert underwriters are dedicated to extending insurability to more businesses. We’ll work with you to tailor each quote and find creative solutions to complex risks—providing fast, accurate, and fully customized quotes for your clients.

If you need additional guidance during the cyber underwriting process, our risk advisors and claims team are available for on-demand consultations.

During the policy period, you and your clients can access on-demand support whenever it’s needed. Whether you need insights on the latest cyber incidents or help with a claim, our in-house team of expert underwriters, risk advisors, and claims specialists are just a phone call or email away.